velcom Leads the Wireless Market in Belarus with SDR Base Stations

Located in the heart of Europe, Belarus is a landlocked country bordering Russia, Latvia, Poland, Lithuania and Ukraine, with a total area of 207,600 square kilometers. Belarus has a stable political situation and a good economic base. velcom is a branch of Telekom Austria, with 4.86 million subscribers. It has the same market share as MTS (5 million subscribers) and much higher than the third one Life (1.6 million subscribers).

Weakness of velcom's Network

The wireless market in Belarus is mature, and the competition between velcom and MTS is fierce. As velcom's 2G and 3G base stations belong to three different vendors, the interoperability between these devices leads to complex networking and high equipment O&M cost. Each year velcom's Opex is high. Moreover, some vendors do not support the evolution of new technologies such as LTE and NB-IoT.

velcom's strategic vision is to deploy LTE, create a minimalist network, provide the best network experience, and reduce Capex and Opex to become the leader in Belarus' wireless market. The above-mentioned problems seriously restrict the realization of velcom's vision.

Rebuilding the Network with SDR Solution

velcom wanted to be supplied by a single vendor, whose base stations would support both 2G, 3G and 4G, so that it could attract customers and take a leading position in the fierce market competition through the best network quality and service. ZTE found favor with velcom for its small-size, large-capacity, and low-power consumption multi-mode base stations, as well as rich experience in project implementation, and velcom selected ZTE as a single vendor in its wireless SRAN project.

ZTE's wireless SDR solution based on the industry-leading MicroTCA standard hardware platform supports GUFTN multi-mode deep integration, high-capacity multi-mode baseband boards, and unified EMS. The solution can meet velcom's needs and perfectly solve its pain points.

In 2016, ZTE completed the replacement of velcom's network equipment in a short period of 11 months. "Due to the excellent cooperation between velcom and ZTE project team, we were able to achieve an average site swap number of over 80 sites per week, and during the hot phase even more than 110 sites per week have been swapped. Finally all works on site were conducted effeciently, with required quality and safety. I would like to express my high appreciation to ZTE local team and R&D's efforts and the support of ZTE Austria, dedication and contribution to such challenging and complicated missions," said velcom CTO Christian Laque. After the replacement, the network could provide better KPIs and support LTE. Since then, velcom started to work ambitiously on the LTE market.

Failure to Acquire LTE License

In 2016, Becloud, a newcomer to the wireless market in Belarus, had the only LTE licence in Belarus, and MTS and Life chose to rent Becloud's LTE network. Though velcom built its own LTE network, it has not obtained the LTE license for a long time. Taking advantage of this time window, MTS and Life launched LTE advertisements all over the place, and adopted the strategy of low-fee LTE traffic packages, which attracted a large number of users in a short period of time and made velcom very passive. In the face of customer churn, falling revenue, and possible waste of investment in the LTE network, velcom was under enormous pressure.

Leading Wireless Market with Flexible Multi-Mode Base Stations

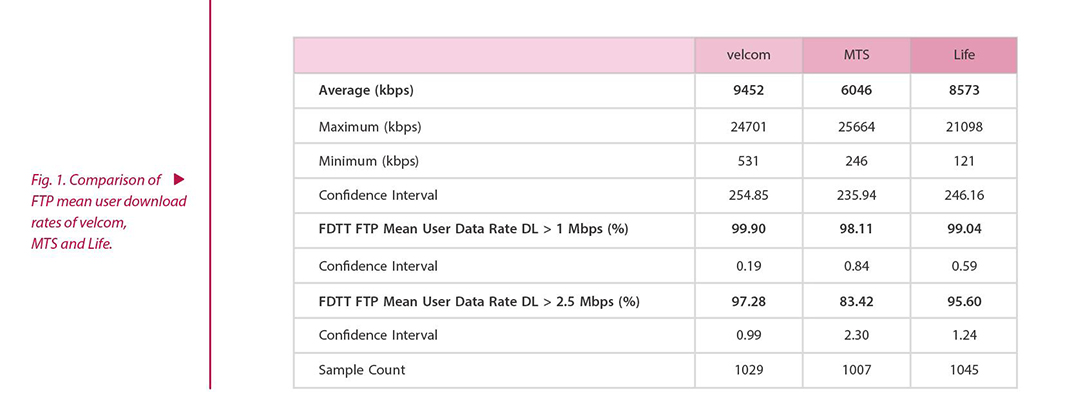

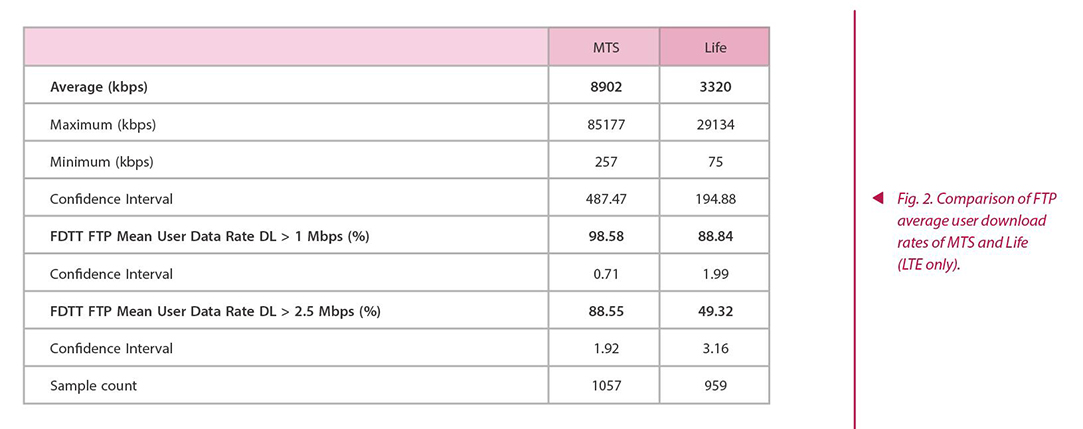

velcom was not knocked down by the failure in acquiring LTE license, but shifted its focus to the development of UMTS network. ZTE's SDR platform and GUFTN multi-mode base stations can achieve flexible configuration of 2G, 3G and 4G baseband resources. The conversion of 2G, 3G and 4G baseband resources can be implemented quickly only through the configuration of unified network management system. This not only avoids the waste of investment in the LTE network, but also leaves sufficient resources for the UMTS network. With its large-capacity UMTS network, velcom launched low-fee traffic packages and received excellent feedback from the market, resulting in a sharp rise in velcom's PS data traffic. In 2017 and 2018, velcom's revenue, profit and ARPU from the wireless market were ahead of MTS and became the market leader in Belarus. Without an LTE license, the average user download rate of velcom's UMTS network in 2018 according to the third party dmtel was still higher than that of MTS/Life's LTE networks (Fig. 1 and Fig. 2). Velcom provided excellent user experience.

New Technology Innovation

To strengthen its leading position in the wireless market, velcom has begun to explore new services. With ZTE's SDR multi-mode base stations, velcom launched Belarus' first commercial NB-IoT network at the end of 2017 and began the development of NB-IoT services. The introduction of NB-IoT technology will bring brand-new service experience to the Belarusian people. It will also drive the development of NB-IoT design and integration industry, promote social innovation and create more employment opportunities in Belarus.