IPTV Equipment Market Analysis

IPTV Industry Development

IPTV is regarded as a profitable sector in developed as well as developing markets. Unlike traditional cable or wireless TV, IPTV enables broadband Internet users to access TV broadcasting services on their computers or TV sets with a set-top box. Some advanced mobile phone subscribers can also be IPTV subscribers with the technological advancements.

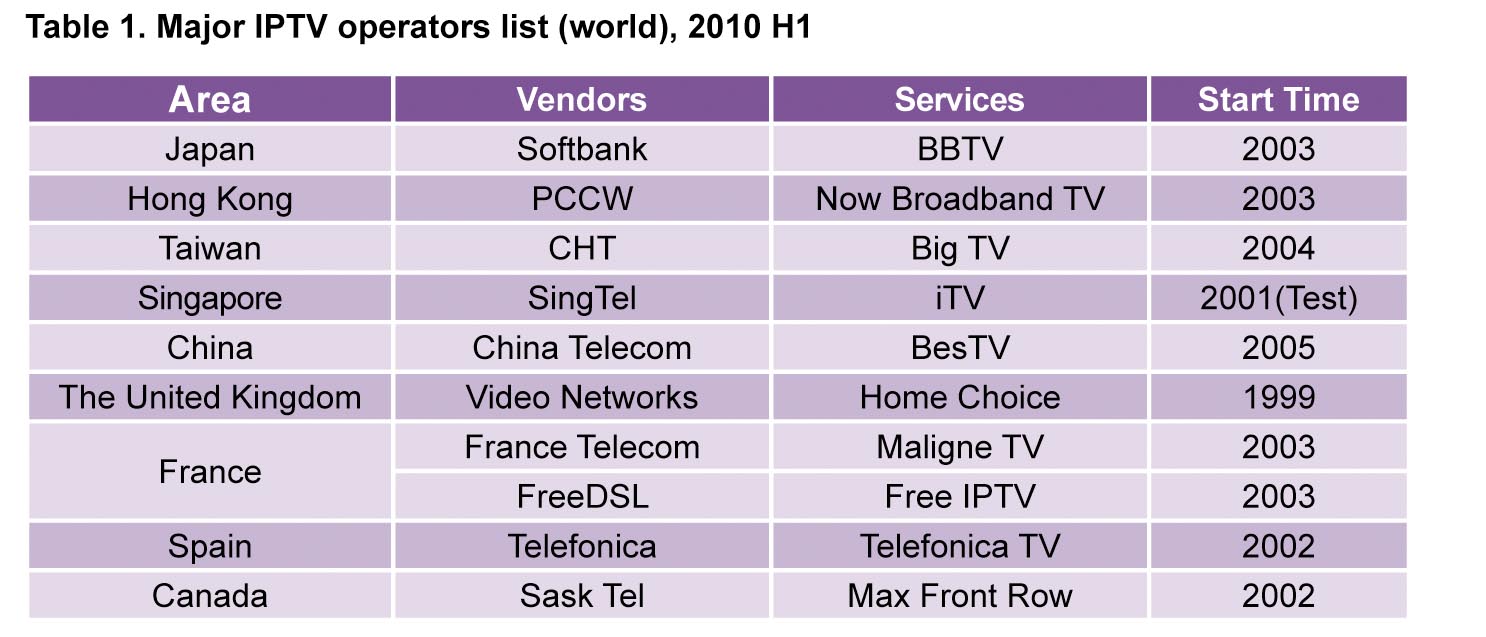

Earlier, IPTV service launches were from large fixed network telecom operators in Western Europe and from PCCW in Asia Pacific. Today many providers around the globe offer IPTV services and are competing with traditional Pay TV providers.

As the IPTV market matures, many innovations are emerging, while service providers are turning to over-the-top video applications to supplement their video-on-demand offerings. Technical upgrades also contribute to growth, including DVRs, high-definition programming, MPEG-4/H.264, and first class system integration.

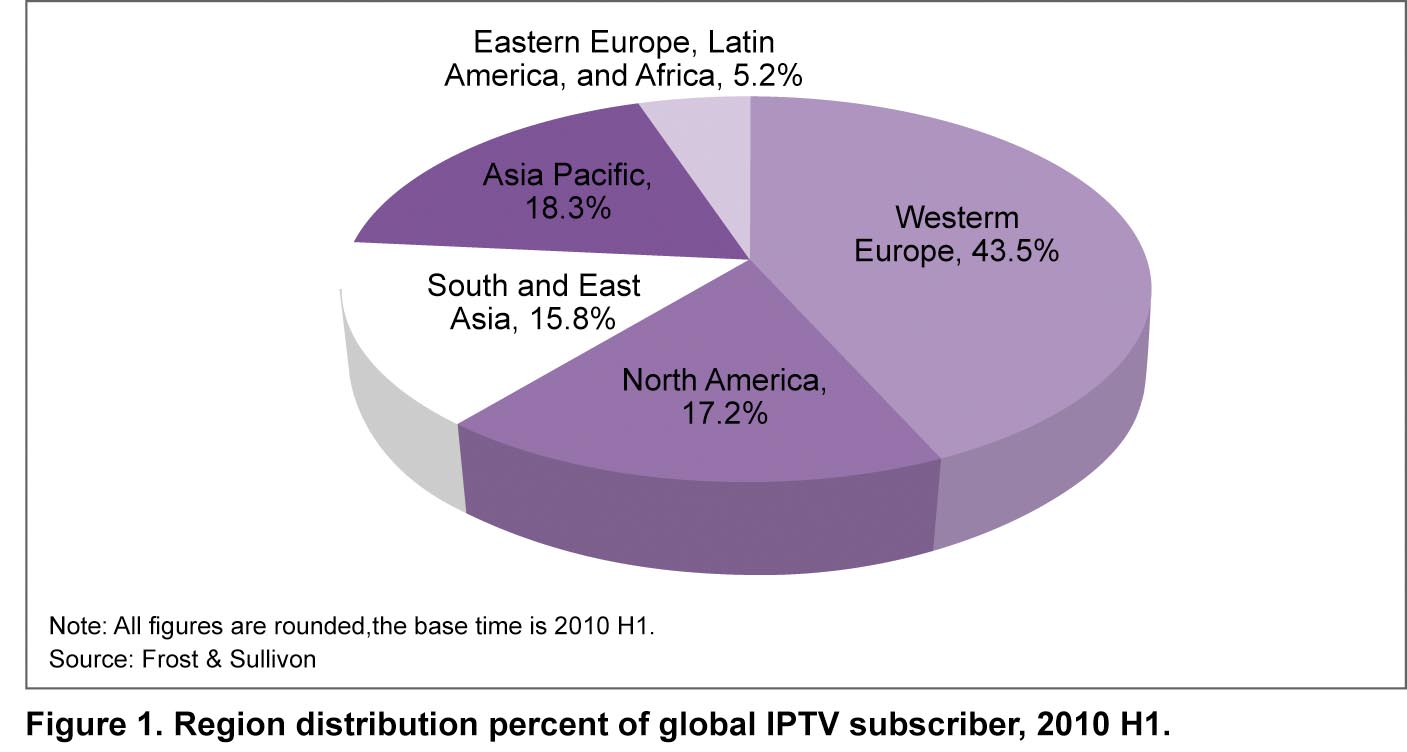

Asia Pacific and Western Europe have 61.8% of the global IPTV subscriber base. The IPTV market is expected to experience rapid growth, as there are large numbers of broadband subscribers that can potentially take up IPTV service. In Western Europe, which is the oldest IPTV market, IPTV has already emerged a major Pay TV platform and has captured about 18.1% of the Pay TV market.

Global IPTV industry overview

Global IPTV subscriber base has been growing rapidly since 2005, at an average annual growth rate of 103.0%. Even during the global economic slowdown in 2008, IPTV subscriber base recorded a large increase. The global IPTV subscriber base reached 37.6 million by the end of 2009, and is forecast to 267.9 million by 2014. The global IPTV market revenues have increased from $0.45 billion in 2005 to $12.1 billion in 2009, at an average annual growth rate of 127.7%.

Analysis of major IPTV operators

The global IPTV market is dominated by a group of mainstream operators. As seen in Table 1, European operators accounted for half of the Top ten operators. Accordingly, market concentration in Western Europe is higher than others. In Western Europe, FreeDSL and France Telecom from France ranked first and second, respectively, in terms of subscriber size.

In 2009, China Telecom experienced a two-fold growth in subscriber size. In 2010 H1, in terms of IPTV subscriber base, China has contributed 43.0% of the total incremental subscribers around the world.

As an example, China Telecom defined IPTV as a strategic emerging service and hoped to improve the sustainable development of broadband services by entering the business field of video services. As IPTV business in China is not regarded as telecommunication services, the licensing is handled by the National Broadcasting and TV Administration. Therefore, China Telecom entered into a joint venture with Shanghai Media Group (SMG) that owned IPTV license to develop IPTV business. In the video services, SMG had extensive experience in the content and operation.

Emerging IPTV market development analysis

The worldwide IPTV subscribers are forecast to reach to 95.9 million in 2011, in which Western Europe, North America, and Asia Pacific are expected to be the biggest markets in terms of revenues per user.

As seen in Figure 1, being a major source of IPTV subscriber, Western Europe accounted for about 43.5% of the total market in 2010 H1.

Currently, Europe is the largest and most active IPTV market, but in future, Asia Pacific is expected to outgrow Europe in terms of subscribers, service revenues, infrastructure, and so on. The broadband penetration of the region will fuel the growth.

The North American IPTV market is expected to be the most competitive in the world largely due to high pay-TV penetration, stiff prices, and intense service competition.

Deployment of IPTV has been spurred by the explosion of broadband in various high growth markets across the globe, such as Asia Pacific. Along with this, innovation, convergence and changing consumer behavior in North America are working as driving forces for the IPTV industry.

Affected by the business opportunities including 2008 Beijing Olympics and Expo 2010 Shanghai, China’s IPTV market maintains steady growth. With China Telecom’s promotion, IPTV has favorable development in Shanghai, Jiangsu, Guangdong, Fujian, and Zhejiang provinces. However, affected by insufficient contents and low price promotion, China’s IPTV business was unable to grow as per the expectation, and the number of IPTV home subscribers has not increased significantly. Hence, many vendors have started to focus on IPTV industry application.

China had more than 700 million mobile phone subscribers, 170 million cable TV subscribers, and more than 100 million broadband subscribers until 2010 H1. The booming IPTV market is really an emerging big money-maker for telecom operators, equipment and software vendors and broadcasters.

IPTV Equipment Competitive Landscape

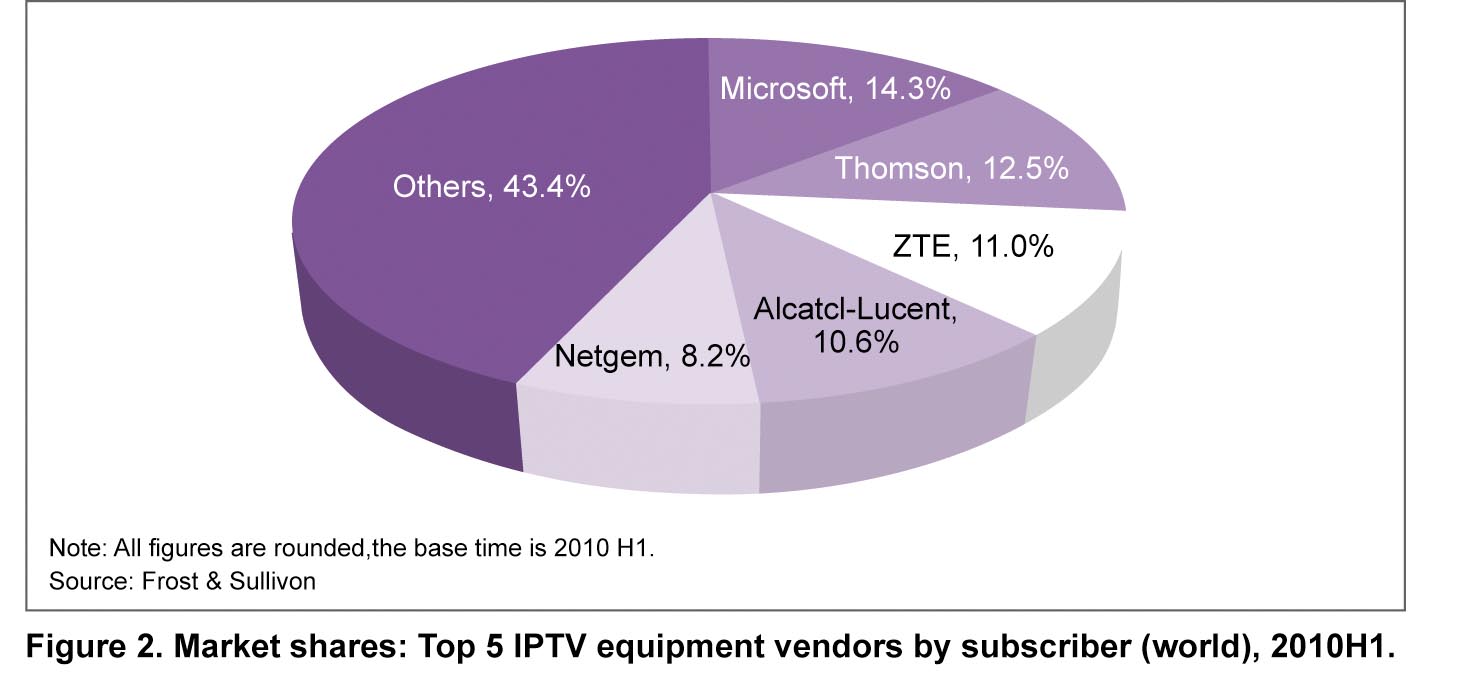

The global market has witnessed an increasing competition, especially for the equipment vendors. In terms of global IPTV subscribers until 2010 H1, Microsoft, Thomson, ZTE, Alcatel-Lucent, Netgem, and UTstarcom are expected to be the major IPTV equipment vendors around the world. Other leading IPTV vendors also provide diversified IPTV solutions.

Market share analysis of major IPTV equipment vendors

Due to its influence in North America and Europe, Microsoft was ranked first with 13.7% share in the world IPTV middleware market in 2009. Thomson benefited from development of FT’s IPTV business and was ranked second with 12.2% share. ZTE surpassed Alcatel-Lucent and ranked third with 10.0% share, through its active market exploration in Asia, South America, and other emerging markets. Alcatel-Lucent and UTstarcom were ranked fourth and fifth, with market shares of 9.5% and 7.9%, respectively. Top five equipment vendors together held about 53.3% market share around the world, but none of them had gained overwhelming leadership of the global market.

As seen in Figure 2, in terms of subscribers, the top five IPTV equipment vendors were Microsoft, Thomson, ZTE, Alcatel-Lucent, and Netgem until 2010 H1.

Network providers, such as Alcatel-Lucent, Thomson, and ZTE, are in the first category. They offer end-to-end solution through self R&D effort or M&A of professional participants. Additionally, based on their broadband infrastructure business, they can provide integrated solution of triple-play to meet operators’ demand of network upgrading and development of VAS. In the past two years, providers of this kind, such as Motorola, Cisco, and Ericsson, are active in IPTV market and they have been improving their whole solution capability through M&A and strategic alliance.

Microsoft is a typical representative of integrated solution providers. Initially it was involved in IPTV market from middleware provision and extended to provision of other infrastructure devices. Through cooperation with server providers (such as IBM and HP), and other participants in IPTV chain industry, Microsoft is able to provide pre-integrated solution and promote its business globally based on brand influence.

Others can be classified as professional middleware providers, such as Espial and Orca. They focus on software technology and provide open middleware framework. As relatively smaller providers, they form alliance with providers of DRM and VOD to improve their position in the market.

Regional analysis of major IPTV vendors

By 2014, the most of the new subscribers additions are also expected to come from the emerging markets. The markets of China, Indonesia, Vietnam, India, Thailand and Philippines will account for 62.0% of the subscriber additions from 2009 to 2014. In these markets IPTV will be restricted to the urban areas where high speed broadband networks are present.

The top IPTV middleware vendors, such as ZTE, UTstarcom, Cascade, Microsoft, and Huawei compete intensely in Asia Pacific. Asia Pacific has the distinction of having the most successful IPTV operators globally, and rollouts continue throughout the region, operators continue to face challenges in three key areas: regulatory constraints, content, and technology costs.

ZTE has great influence in some regional markets, such as Asia, South America and the Middle East. In Asian IPTV middleware market in 2010 H1, ZTE ranked No.1 in terms of its comprehensive factors including the financial situation, investment levels, and business prospects. In China IPTV middleware market in 2010 H1, ZTE also ranked No.1 by achieving the leading edge according to its long-term R&D effort and market performance. On the basis of large scale IPTV deployment with China Telecom, ZTE has cooperated with many other operators, such as VNPT who is the largest operator in Vietnam, TelKom Indonesia who is the largest operator in Indonesia, and CANTV who is the largest operator in Venezuela, and successfully increased their subscriber capability with low cost.

China has overtaken South Korea as the largest IPTV market in Asia Pacific and had 4.7 million subscribers at the end of 2009. The IPTV subscriber surge in China is happening due to push by fixed broadband providers to become multi play providers. In South Korea, broadcast content for IPTV was allowed by the regulator only at the end of 2009 and vast majority of the subscribers currently have VOD only service.

For example, Jiangsu Telecom started developing its IPTV business in 2005, with the view of exploiting its advantageous resources to retain old users and attract new ones. The company’s IPTV business grew quickly after close cooperation with ZTE. With strong support from ZTE, Jiangsu Telecom IPTV system ensures the subscribers receive high Quality of Service (QoS) as well as Quality of Experience (QoE). Until June 2010, Jiangsu Telecom IPTV system reached a capacity of 2.52 million subscribers (including 1.58 million activated subscribers). IPTV has played a key role in driving Jiangsu Telecom towards full-service operation.

Forecasts of IPTV Market and Technologies

IPTV market trends analysis

The applications and services introduced by IPTV are changing the TV viewing experience. Network-based time shifting capabilities, video- and TV-on-demand, and real interactivity are expected to significantly affect consumers’ viewing habits. For example, currently viewers can watch a TV program at their own convenient time. In a few years, it can be possible that only real-time events, such as recitals, sports matches and breaking news, and certain high audience TV shows will be watched in real time while everything else will be time-shifted.

As seen in Figure 3, in terms of subscriber base, the global IPTV market is expected to maintain high growth rate for the future four years. The global IPTV subscribers are likely to increase to 62.1 million until 2010, and will reach 267.9 million until 2014, growing at a CAGR of 44.1%.

The global IPTV market is valued $17.5 billion in 2010 and is forecast to grow to $46.5 billion in 2014, at a CAGR of 27.7%. By 2014, Europe and North America will generate a larger share of the global revenue, due to very low ARPUs in China and India, the fastest growing (as well as the largest) markets in Asia.

IPTV technology trends analysis

■ TV: TVs with Internet capability and built-in widget engines are being launched. LED TVs are in the market and prices are expected to continue to fall. Internet capable TVs are also merging IPTV with Internet video services.

■ Set-Top Box (STB): STBs now support content storage. IPTV STB prices are expected to fall and TVs with integrated STBs are being launched. If STBs are completely standardized and can be bought off the self by consumers, IPTV service will get a major boost.

■ The network: Increased demand for higher speeds because of video applications is increasing deployment of FTTH broadband networks.

■ Applications: With convergence of IT and communications, innovation in communications applications is happening at a rapid pace.

■ Innovative and interactive IPTV services: The first interactive services to be launched by IPTV providers were VOD and time shifted viewing. The interactive services being offered currently revolve mainly around online shopping/ticketing, gaming, Internet-on-TV, and phone handling from TV. Some providers are also planning to offer services for different verticals such as healthcare, transport, and education. The markets of South Korea and Hong Kong feature some of the most interactive IPTV services in the world.

■ Convergence and digital home: Multi play operators are deploying IMS architecture to offer converged services to their subscribers across multiple telecom service platforms. Providers such as SingTel and PCCW offer a converged IPTV and mobile TV offering. Providers are complementing their IPTV service with Internet TV and mobile TV. Pay TV is evolving to become a single service that can be enjoyed on the TV, mobile, or Internet by consumers. Digital home services are still at a concept stage in most markets. The popular services are basic networking of home PCs and computer accessories. Operators are planning to use IPTV and broadband network to digitize homes and connect various devices online.

With the development of global broadband market, IPTV content and application play more important roles nowadays. As one of new broadband applications, IPTV has attracted comprehensive attention around the industry. As Europe, Asia and North America begin to experiment and play TV programs through the IP transmission network, IPTV market growth is likely to accelerate from now on.