MRG IPTV Market Leader Report—End 2013 Summary

MRG’s IPTV Market Leader Report (MLR) identifies which IPTV systems and software companies are leading each of the six IPTV market segments: access systems, video headend (encoder) systems (VHE), video-on-demand server software (VOD), set-top boxes (STB), middleware (MW), and content protection/digital rights management (CP/DRM).

Among the global leaders, the big winner was ZTE taking the top position in VOD, STB and middleware. Alcatel-Lucent continues to lead in access, while Verimatrix continues to lead in the CP/DRM segment and Harmonic leads in video headends. ZTE has been successful in working with many Asian IPTV operators.

Among the major changes in this report are acquisitions that have closed recently. Ericsson acquired the assets of Microsoft’s Mediaroom technology so all Mediaroom customers are now under Ericsson in this report. In addition, ARRIS completed its acquisition of Motorola’s assets from Google so ARRIS now appears in new product categories. Interestingly, ZTE has taken the lead in middleware in this report, replacing Microsoft’s Mediaroom (now Ericsson) which led for about five years in a row.

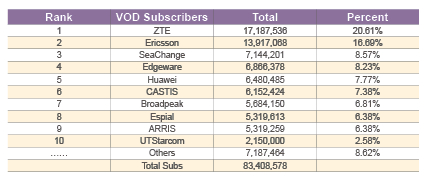

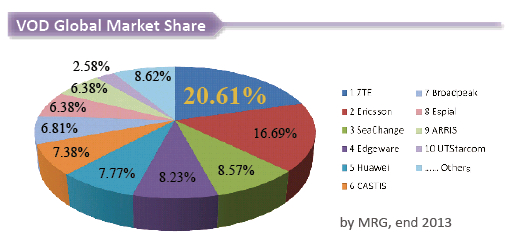

Video-on-Demand Server Software

The VOD segment is the most competitive, with 14 out of the 15 VOD companies reporting over 1 million subscribers each. The leader in VOD is now ZTE with 20.6% of the market, while the previous leader Microsoft (whose Mediaroom technology is now with Ericsson) is now number two at 16.7%. SeaChange is next but it only has an 8.6% market share and customers mostly in North America. Edgeware is at number four (8.2%) while Huawei is number five (7.8%) with these top five vendors accounting for just 62% of the global market.

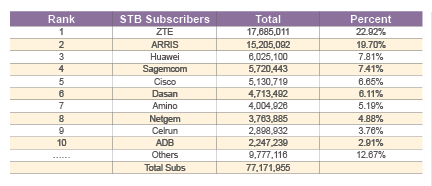

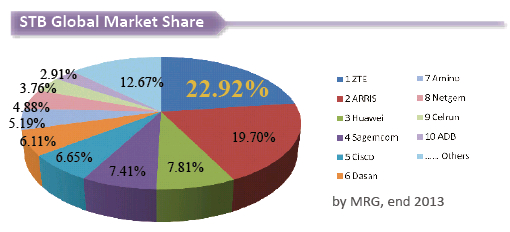

Set-top Boxes

The STB segment is the most crowded with 27 vendors tracked. Once again, ZTE has taken the number one spot globally to reach 22.9%, while ARRIS has dropped to 19.7%. These two companies have the largest market share with number three Huawei only at 7.8%. It seems that ZTE has been able to capitalize on the growing IPTV market in China, where it has most of its business. The top five STB vendors account for almost 65% of the global market.

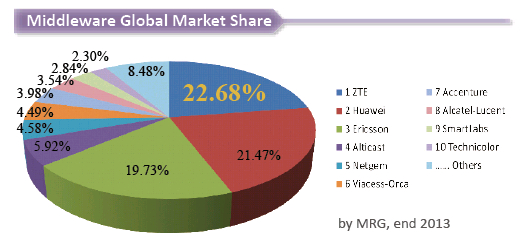

Middleware

The MW segment has also been competitive of late, but once again Microsoft’s Mediaroom (now under Ericsson) has dropped from the top spot. The number one middleware vendor is now ZTE at 22.7%, while Huawei is next at 21.5%. Again, both companies have benefitted from the strong growth in China, forcing Ericsson down to number three at 19.7%. Overall, there are 23 vendors, making it one of the most crowded segments, after STBs. The top five vendors account for 74% of the global middleware market.