Over-The-Top TV for Cord-Cutters

“Cord-cutters” are people who have cancelled their pay TV services and have chosen to watch only online video on a PC, tablet, or big-screen TV with the help of an internet-connected box such as gaming console or over-the-top (OTT) set-top-box. According to Convergence Consulting Group, approximately 4.7 million (4.7%) households in the United States had cut the cord at the end of 2013.

A subgroup of cord-cutters are called “cord-nevers” because they, as the cyber generation, have grown up watching online content only and are unlikely to ever subscribe to any pay TV.

This article aims to analyze the factors behind cord-cutting and suggest ways for pay TV operators to win back the cord-cutters.

The Decline in Traditional TV Watching Time

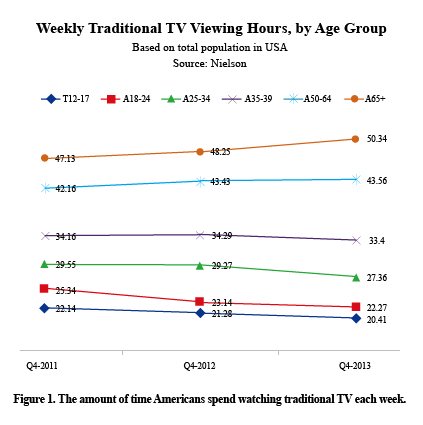

According to a recent Nelson study on the amount of time Americans spend watching traditional TV, all age groups under 49 are watching less TV each week year-over-year, whereas only people over 50 are watching more. Part of the reason is that young people have so many choices and are unwilling to sit before a TV set to wait for their interested shows to appear.

Another popular behavior is binge viewing, i.e., watching multiple episodes of a show one after the other. A binge viewer may be a busy person who has just allocated some spare time to sit down and catch up on his/her favorite TV series. Or it may be someone who becomes absorbed in the plot and can’t wait to find out what happens next.

These are just some of the shortcomings of traditional pay TV that cannot meet the expectations of modern-day viewers.

Annoying TV Bundles

The typical monthly cable TV bill in the US is $90, according to market research group NPD. The cheapest monthly internet, TV, and phone bundle in Los Angeles is $80, according to the New American Foundation. Similar bundles cost $32 in Paris and $15 in Seoul.

With an expensive TV bill but less than 20% of actually interesting channels, the subscribers become angry with the operator for no ways to opt out selectively.

However, dissatisfaction with pay TV operators is misplaced because these operators source their channels from content providers, who usually deal only in bundles.

Cablevision Networks, a US cable operator well known for challenging old rules and trying out new ideas, filed a lawsuit in February 2013 against Viacom, a content supplier, alleging that Viacom was forcing Cablevision to pay for 14 infrequently watched ancillary networks (e.g. VH1 Classic) that “its customers do not want” but that were bundled together with popular channels like MTV, Comedy Central, and Nickelodeon.

Viacom argued that the bundles were not “abuse of market power” but purely business discounts to lower the price of individual channels. In other words, buying individual channels would be more expensive.

The fight over content bundles is still proceeding through different courts, and many subscribers have lost patience and decided to cut the cord completely.

Rate Hikes Despite Cord-Cutters

The most effective way of winning back cord-cutters would appear to be slashing prices; however, pay TV operators have had to do exactly the opposite due to the rising cost of retransmitting TV signals. These rate hikes have further alienated viewers and pushed them to cut the cord more quickly.

The long-term impact is a vicious circle: The fewer subscribers that service providers have, the higher the monthly fee that these subscribers have to pay. In turn, more subscribers will opt out.

To minimize the loss due to cord-cutting, the operators keep increasing the price of their internet access service. According to a report by SNL.com, the price of basic internet tier in Philadelphia and Atlanta increased 30% by the local phone company and 50% by the local cable company from 2009 to 2013.

The Attractiveness of OTT TV

In many ways, the advantages of OTT TV over traditional TV are similar to the charms of mobile phones over fixed-line phones:

● OTT TV can be personal, unlike a family-based big-screen TV, and recommendations made to the viewer are relevant.

● On a big-screen family TV, choice of TV channel, viewing history, and DVD recordings can be seen by everyone in the home. With an OTT TV, individual user behavior is private, and the viewer shares this information only when she/he wants to share.

● OTT TV can be watched anywhere within or outside the home.

● OTT TV can be watched at any time using wired internet, Wi-Fi, mobile broadband, or offline (through downloading or side loading).

The Key Technologies for OTT TV

Although attractive to end users, OTT TV does not guarantee video quality over unmanaged public internet, and this may cause viewer dissatisfaction. There are two key technologies for OTT TV: content delivery networks (CDN) and adaptive bitrate streaming (ABS).

CDN is deployed to boost OTT TV user experience by moving OTT contents to the network edge, as close to user devices as possible.

ABS relies on a physiological and psychological finding that the smoothness is more critical to human perception of audio/video quality than its resolution. In other words, viewers cannot tolerate frequent jitters and buffering; yet they will accept less detail for a smoother audio-visual experience.

There are many proprietary ABS formats, including Apple’s HTTP live streaming (HLS), Microsoft’s smooth streaming, and Adobe’s HTTP dynamic streaming (HDS). MPEG-DASH (dynamic adaptive streaming over HTTP) is an international standard on ABS but, as a latecomer, it needs more time to gain acceptance.

Progress on Premium Channels

Most of the popular OTT TV services, including YouTube, Amazon Instant Video, Apple iTunes, and Xbox Gold, offer only on-demand video and music content but no live TV channels.

Some ethnic TV service providers in North America, such as KylinTV and iTalkTV (for Chinese immigrant communities) have been leaders in offering live OTT channels. A few mainstream TV service providers in Asia Pacific, including China Telecom, China Mobile, and Telekom Indonesia have started offering live TV channels to OTT set-top boxes thanks to relatively open and cooperative relationships between TV operators and local content owners.

However, premium live channels, such as ESPN, CNN, and Disney are not yet available on OTT TV services worldwide. This is effective in keeping many TV lovers, especially sports fans, from unsubscribing pay TV services, and it is often deemed the TV operator’s final line of defense against cord-cutting.

A recent deal within the media industry is a step in the right direction. In March 2014, DISH Networks attained the rights from Disney to provide the Disney Channel, ABC and ESPN as OTT channels. However, one significant restriction is that DISH cannot sell these channels individually. DISH also has to agree to fair-play requests by Cable TV operators, who represent current Disney customers, and sell the same tier bundles as the cable TV operators. This means that DISH has to negotiate OTT rights with the likes of Time Warner Cable, CNN and HBO as well as Disney. It also means that OTT TV users still cannot choose the premium channels as freely as they wish.

Nevertheless, the good news is that the DISH-Disney agreement allows DISH to charge each individual viewer in a family, which is a significant change from the current cable-TV model based on one monthly fee for the entire household. This new OTT TV service will surely be cheaper and more personalized.

A Better Future

The future of OTT TV can move in two conflicting directions: “customer first” or “content is king.”

Customers always look for better contents with lower fees whereas content owners and pay TV operators need to increase return on investment, i.e. attracting more subscribers and getting more profit from each subscriber.

Cord cutters can expect some premium live OTT channels eventually; however, the actual savings by cord-cutting will be partially offset by the rising cost of internet access.

Pay TV operators should offer some inexpensive a-la-carte premium channels and give customers some freedom of choices. They should also integrate popular OTT services, such as YouTube, Netflix, and Hulu, with their pay TV offerings, just like what ZTE is doing in its IPTV+OTT global deployments, and give customers the convenience of accessing both services with the same set-top boxes. This will likely reduce the need for many customers to cut the cord completely.