Uni-RAN Booming in Europe

“We chose ZTE Uni-RAN solution to cover the central region of Portugal, not only to upgrade the existing networks, but also to prepare for the future evolution of LTE, staying ahead of the competition," said José Pinto Correia, CTO of Optimus.

Obstacles to Revenue Growth

Europe is the most developed telecom market in the world, and leads the development of the global telecom industry. Mobile penetration throughout the continent now exceeds 100% while voice ARPU continues to drop every year. The era of generating revenue by expanding subscriber base has gone. Operators now look to data services as a way of stimulating revenue growth.

Multimedia smartphones such as iPhone and Blackberry support a variety of data applications, and as their popularity increases, the mobile broadband data business approaches a golden age of development. However, mass data traffic does not generate revenue for operators. On the contrary, networks become more complicated, subscriber bandwidth requirements rapidly increase, and CAPEX and OPEX tend to increase also. Network performance-to-price must be improved, network complexity reduced, and savings made on cost per bit. In other words, operators must provide higher access rates, larger network capacity, and higher spectrum efficiency at lower costs. Responding to these needs, HSPA+/LTE has emerged as an industry-leading mobile broadband solution because of its good forward compatibility, interoperability with exiting 2G/3G systems, and low cost per bit.

Requirements of European Operators

Europe is a playground for top network operators. Known as a benchmark setter, Vodafone leads in technological development and provides fast customization and smooth evolution. France Telecom emphasizes project delivery, network O&M, and long-term cooperation with equipment vendors. Telenor has its eyes set on energy saving and cost reduction throughout the lifecycle of a network.

Because of the widespread availability of 2G and 3G terminals in the European market, conventional voice services are still in great demand and it is impossible to update networks to LTE overnight. 2G, 3G, and LTE systems will coexist for some time to come, each playing their own role. After years of optimization and evolution, GSM networks can now provide almost complete coverage—from rural to urban, indoor to outdoor areas. GSM provides subscribers with basic voice and SMS services, while LTE offers high-speed data services in urban hotspot areas.

In the wake of the global economic crisis, operators are more prudent with their investments. To satisfy increasing communication needs, the process of technological evolution is being sped up—from 2G to 3G and LTE. Multiple wireless standards will coexist for a long time. Helping operators reduce CAPEX, protect investments, quickly deploy new technologies, and cut down multi-network O&M have become a major concern for equipment vendors. Smooth upgrade and evolution, as well as unified network O&M will free operators from network construction and O&M, and allow them to focus more on business development. The choice of platform will affect network development and O&M well into the future. A European operator, for example, has used GSM equipment for 15 years and UMTS equipment for more than 6 years. Their old equipment occupies a large amount of room and consumes a great deal of electricity every year. To run two independent networks, a lot of manpower and material resources are needed, and these result in high OPEX. Moreover, the operator is also pressed to replace aging GSM equipment with new technologies such as E-Edge, HSPA+, and LTE.

The telecom industry recognizes that environmental awareness must be a core value, and has set targets for energy conservation and emissions reduction. The Global Mobile Suppliers Association (GSA) has set a goal to cut emissions across the industry by at least 40% of 1990 levels. The goal should be achieved by 2020 while maintaining a 70% growth in business. Energy savings and emissions reduction is not only a social requirement, but also fulfills operators’ desires for corporate social responsibility and to cut down costs.

Uni-RAN: The Choice for Converged GSM/UMTS/LTE

Today, radio communications technologies are developing rapidly, and subscriber requirements are becoming more diverse and personalized. Conventional base stations and networking modes cannot support smooth upgrade and evolution, and this results in high-risk investment and long business cycles. To meet the development trends for mobile communications, ZTE has developed an innovative base station using Soft Defined Radio (SDR) technology. New-generation SDR base stations are a first in the industry, supporting multi-carrier and multi-standard operation, environmental protection, and smooth evolution.

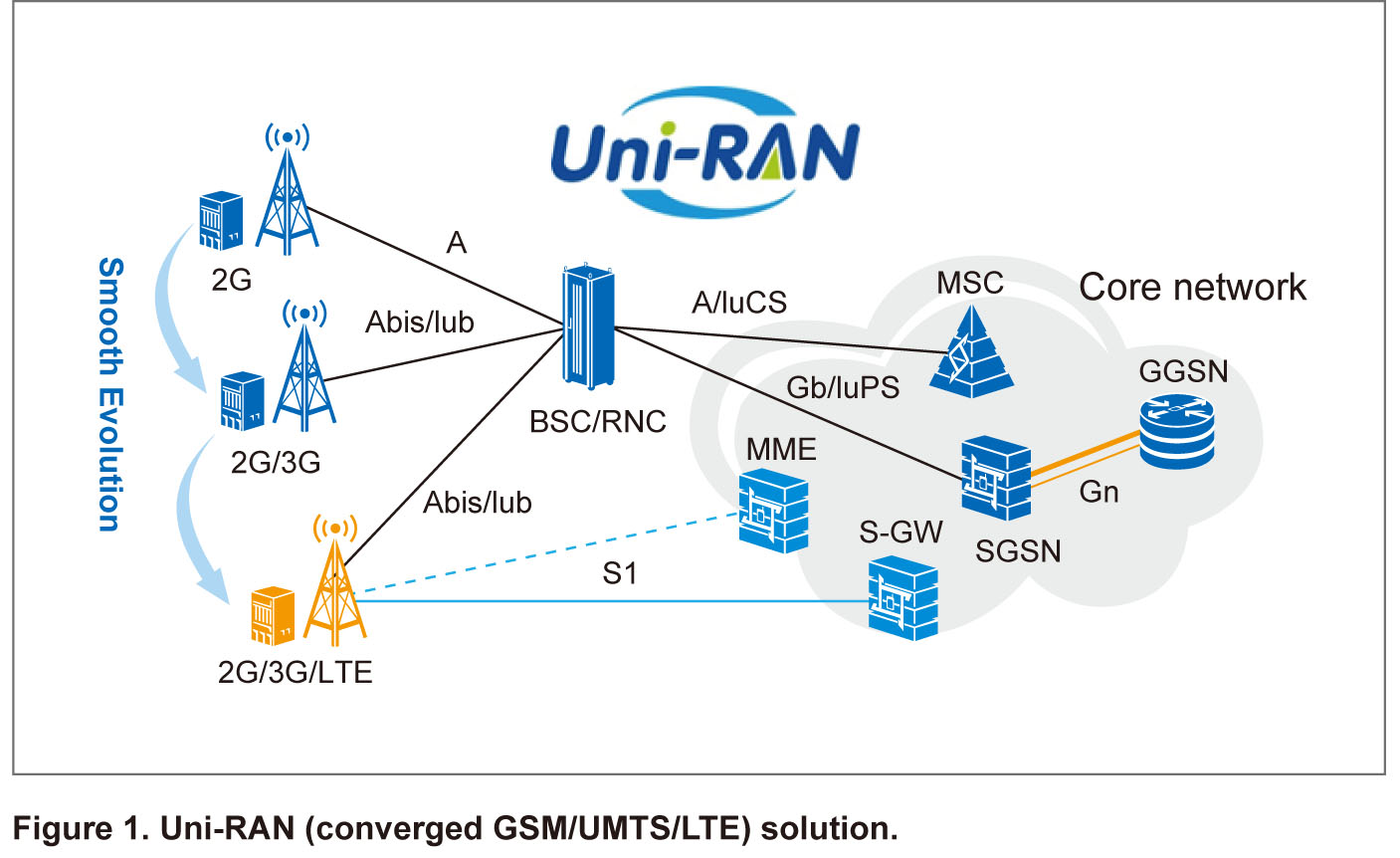

ZTE’s SDR-based Uni-RAN (see Figure 1) allows operators to customize their networks. SDR base stations enable 2G/3G convergence, and support HSPA+ and smooth evolution to LTE through software upgrade. This helps minimize large investments in network reconstruction and migration, and quickly enhances network performance and deployment of new services to counter fierce market competition. New-generation SDR base stations have become the preferred choice for mobile operators worldwide, and Uni-RAN has been recognized as the industry’s leading solution for converged GSM/UMTS/LTE deployment.

With the successful launch of Uni-RAN, ZTE continues to expand its market share in densely-populated emerging countries, and has made breakthroughs in the most competitive European market. Drawing on quality products and efficient project delivery, ZTE has deployed Uni-RAN for European operators including Telenor Montenegro, KPN Germany and Belgium, Sonaecom Portugal, and Cosmote Romania.

The widespread deployment of converged 2G, 3G, and LTE networks in Germany, Belgium, Portugal, Hungary, and Turkey will further enhance ZTE’s capabilities in wireless product delivery, and also allow the company to make great inroads into the European high-end market using its innovative wireless infrastructure equipment.

Milestones

■ September 2009: Promonte, a subsidiary of Telenor and the largest mobile operator in Montenegro, signed a contract with ZTE to swap its GSM/UMTS network with a converged all-IP GSM/UMTS/LTE network using ZTE’s Uni-RAN solution.

■ December 2009: Portuguese operator Optimus signed off on a deal with ZTE to swap its GSM/UMTS network with a converged GSM/UMTS/LTE network using the Uni-RAN solution.

■ December 2009: E-Plus Group Germany and KPN Group Belgium selected ZTE to supply HSPA-enabled 3G equipment for further expansion and technical upgrade of their mobile networks.

■ July 2010: Telenor Hungary signed off on an exclusive deal with ZTE to build, expand, and operate a GSM/UMTS/LTE network in Hungary using ZTE’s Uni-RAN solution.