Business Model Analysis of Managed Services

When bidding begins for large-scale network projects, managed services are often considered an admission ticket. Many operators see managed services as a business strategy for globalization. Vodafone and Warid, for example, use unified RFPs and share bid evaluations, and have built a joint global business evaluation system. South Africa’s MTN is considering adopting a managed services strategy in both developing and undeveloped countries. As well as basic network operation and maintenance, operators are demanding more in terms of revenue management, business management, and terminal management, and managed services have become an increasing focus of attention.

What are Managed Services?

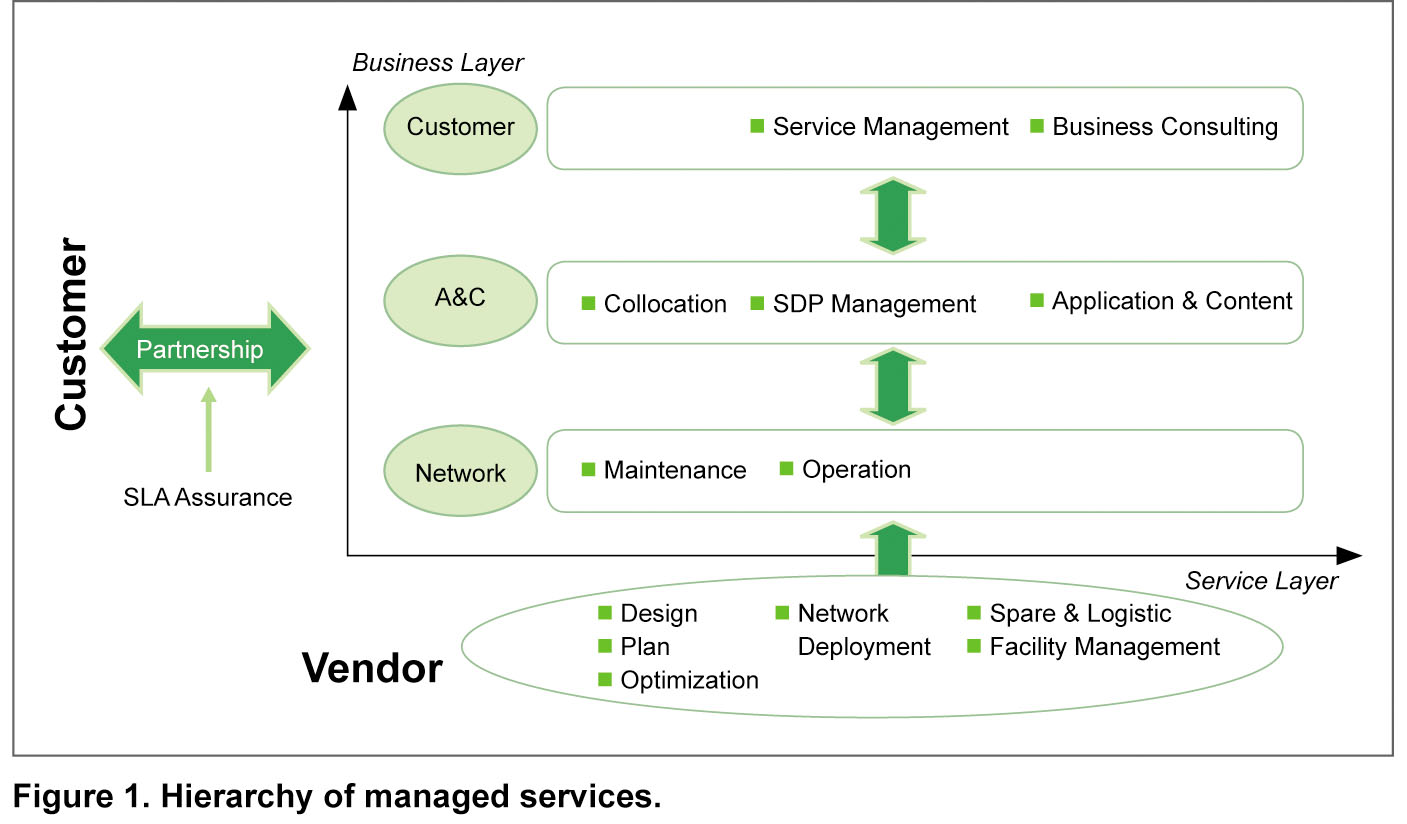

Managed services are professional network management services that include integration; and operation and maintenance of the network layer, business layer, and customer layer based on a Service Level Agreement (SLA). Managed services adopt standard processes, reusable resources, flexible value chain cooperation models, and revenue distribution schemes so that operators can optimize their business and financial performance and focus more on core businesses.

There is no standard definition of managed services, and this is ZTE’s current understanding of application scenarios for managed services in the telecommunications industry. The term “managed services” originally referred to any user facility management service provided by operators to enterprise users. It was overly simple and did not take into account SLAs.

The SLA is the foundation of service delivery, and service capability is an absolute prerequisite. Managed service solutions should adapt to the business models of operators and the following should be considered:

■ Support measures for product solutions (product maintainability, interface openness, and SDP)

■ Integration with third-party products and client devices

■ Delivery cooperation model and income distribution program

Three changes should be considered for business models:

■ Changes in the profit model (resulting from changes in the cost and revenue models)

■ Changes in the value orientation (from equipment selling to service or business selling)

■ Changes in the customer relationship (from a buyer-seller relationship to a partner relationship)

Driving Force of Managed Services

Managed services are driven by the transformation of telecom operations in terms of:

■ Financial targets: As the telecom market continues to slump and the telecom ecosystem deteriorates; new approaches to cost reduction, streamlining revenue, cash flow performance, and ROI must be sought. Among these, reducing OPEX is the most critical.

■ Business performance: New technologies are continually emerging. To increase core competency in the market, new technologies must be obtained and business performance improved at reduced cost.

■ Deployment capability: Since competition is globalizing and new operators are asserting themselves with new technologies in the home markets of other operators, competition has heated up. Shorter time to market for new products and rapid development of new business is therefore necessary to compete.

■ Management optimization: The emergence and convergence of new technologies, new businesses, and complicated value chains have made network management more difficult. Supply chain management, network technologies, and services, need to be simplified and integrated so that operators can focus on core businesses and front-end markets.

■ Risk transfer: The risks associated with new technologies and new businesses should be shared with equipment suppliers in order to minimize investment risk.

Service management is an essential part of the new telecom ecosystem and this creates win-win opportunities for all participants. By optimizing and sharing resources, complementing business abilities, and sharing risk, service management creates additional sources of income.

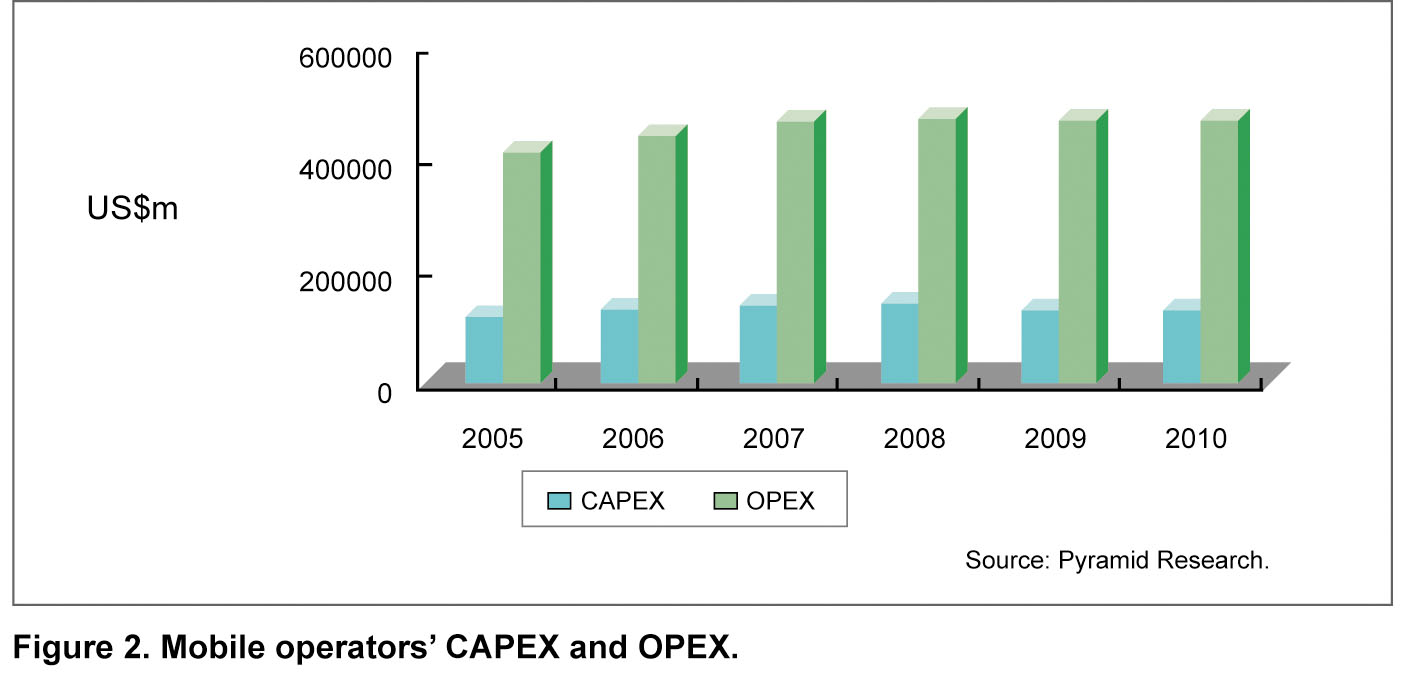

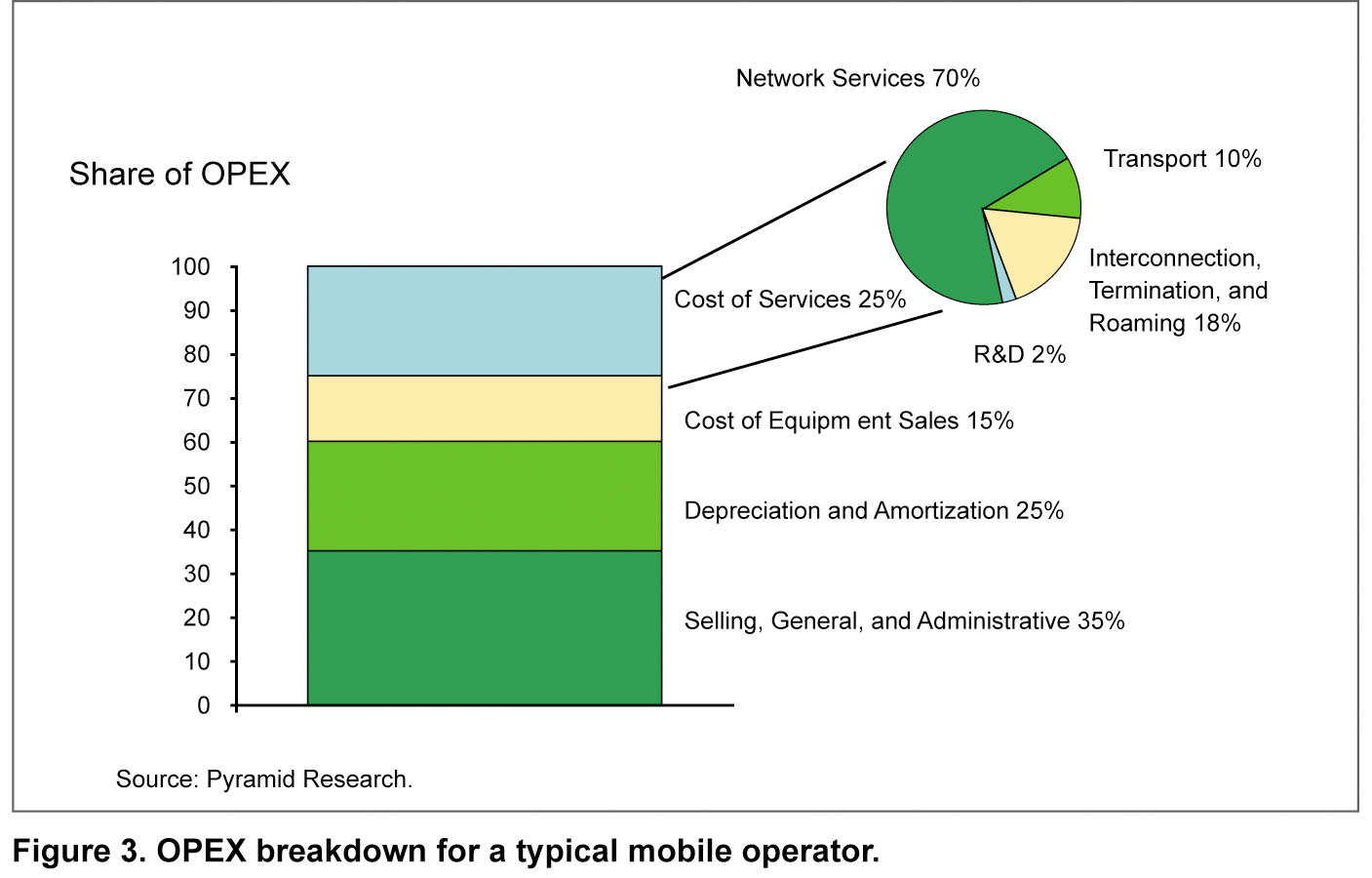

The need for service management is also evident when the CAPEX and OPEX of mobile operators is examined and OPEX broken down (as shown in Figures 2 and 3).

CAPEX of global mobile operators reached peak value (about US$137bn) in 2007 and has declined steadily ever since. New business expenses in CAPEX have increased from 10% in 2000 to 30% in 2010.

OPEX of global mobile operators is three times CAPEX (about US$400-500bn annually). However, since 2008—when operators were equipped with converged, all-IP network technologies—OPEX growth has slowed.

For a typical mobile operator, service costs account for 25% of OPEX, 70% of which are for network service. The ratio of network service expenses to total service expenses in OPEX and CAPEX (e.g. for service management tools) has grown from 33% in 2005 to 45% in 2010.

Conflicts and opportunities in next generation network transformation promote service management:

■ The traditional resource-based profit model of bearer networks is being challenged, and “bit paradox” has become the bottleneck of next generation business network operation.

■ The value chain model is an inevitable trend, and virtual operation and managed services have come into fashion.

■ Managed services at the business layer involve risk sharing while next generation network profit models are sought.

■ The development of an industry profit model goes hand in hand with development of managed services business models. Manufacturers can thus provide more solutions and business models to meet customer needs in the value chain.

Development Trend of Managed Services

Managed service capability is important in the decision-making process for product purchases. Outsourcing of managed services has become a better choice for operators, and it is crucial for manufacturers to provide professional services.

Network-layer managed services will dominate the market, and will be provided by device manufacturers with product operation ability or managed services providers. Business-layer managed services have an uncertain future because industry profit models are still being explored. However, the total available market is growing rapidly and business-based market segmentation needs to be tracked. Marketing of customer-layer managed services will also be segmented and more suppliers will offer managed services.

The growing demand for managed services from virtual operators and enterprises may be a “blue ocean” for traditional network vendors. The active roles of IT enterprises in the managed services field will give rise to new competitive arrangements.

Conclusion

The transformation of the telecom business models has led to the development of managed services. New networks, new businesses, and high-value domains have grown quickly as a result of value chain managed services. The NGN business profit model is still being explored, with risks being shared with manufacturers.

The network layer, business layer, and customer layer have different capability requirements for managed services. Equipment suppliers should develop and offer different managed service solutions according to different paths and modes.

Business models of different manufacturers have a common point in taking advantage of their own products and resources. Managed services capabilities can be improved through organizational transformation, cooperation, and mergers, and profit can be made by selling competitive solutions.