Smart Speakers are Quickly Gaining Popularity in AI Era

AI-enabled smart speakers that allow for chatting, shopping and music-playing have been favored by the households, as evidenced by a string of new highs in shipments reached by them.

The latest data from research firm Canalys showed that global smart speaker shipments had surpassed 100 million units by end-2018 compared with just 40 million in 2017. The figure is likely to climb to 225 million in 2022. Such growth already exceeds the rate at which any consumer electronics grows over the past decade.

Smart speakers have been hailed as a phenomenal product. As new brands enter the fray and there are diverse products, competition is heating up. This is a sign that "the battle of speakers" has begun, with products of all price ranges shaping up to carve out their respective market niches. By the end of 2018, Amazon and Google had gained a worldwide market share of around 80%. China has become the second largest smart speaker market behind the U.S. thanks to a fast expansion in the sector, with Alibaba, Baidu and Xiaomi ranked the top three vendors domestically.

It seems that technology titans are falling all over each other to grab a piece of the smart speaker pie. But why?

Reason: Traffic Portal Is a Must-Win for Industry Players

In the PC era, the traffic portal was operating systems, which enabled Microsoft to dominate all computer interfaces. Search engines, the portal of the internet age, turned Google and Baidu into giants among web companies. The mobile internet era sees the role of the portal played by smartphones and the apps running on them. Apple, Facebook, Alibaba and Tencent have since emerged as industry heavyweights of the era.

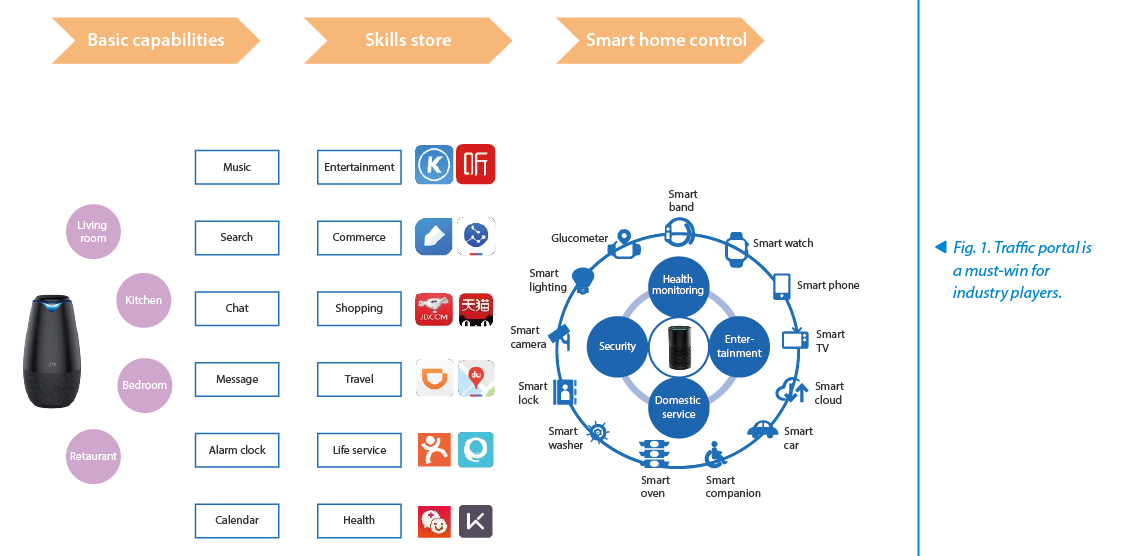

In the AI era, voice interaction becomes the preeminent portal. Because the smart speaker can cover various scenarios of home life, it is the ideal carrier of voice interaction in the home and that in turn makes the smart speaker the perfect candidate as the controller of the smart home and as the portal to search, shopping, content and social media (Fig. 1). Sensing the huge potential of smart speakers, almost all big technology giants are throwing their hats into the ring.

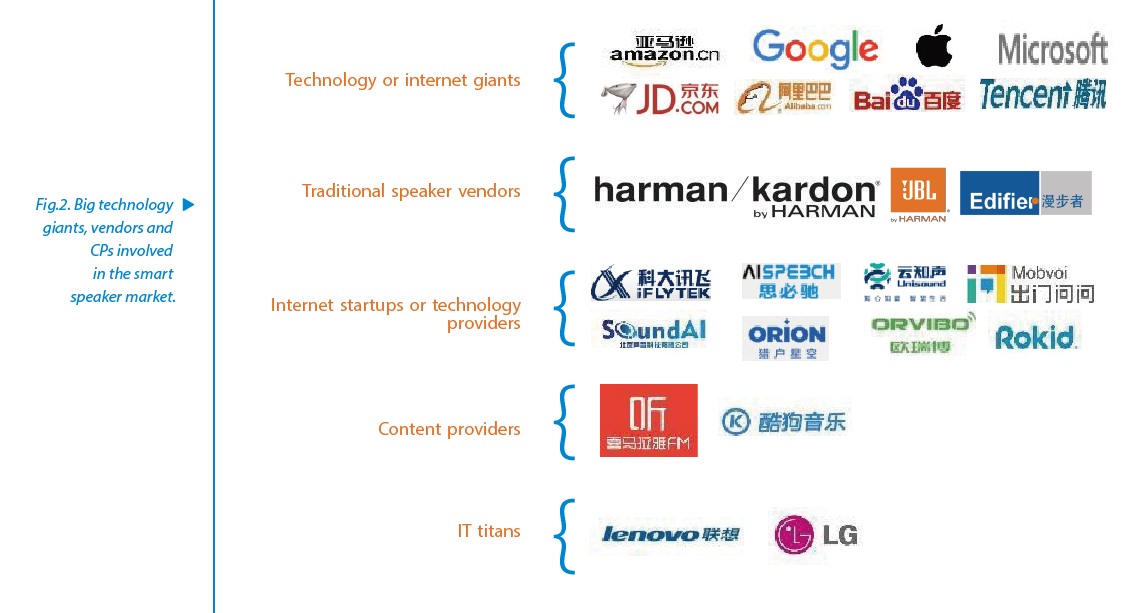

Currently a fierce price war is raging in the smart speaker market. That is because vendors are concerned not about the profitability of the smart speaker but about the big pie associated with it, i.e., the smart home (Fig. 2).

Key: Hardware, Technology and Service Are Indispensable

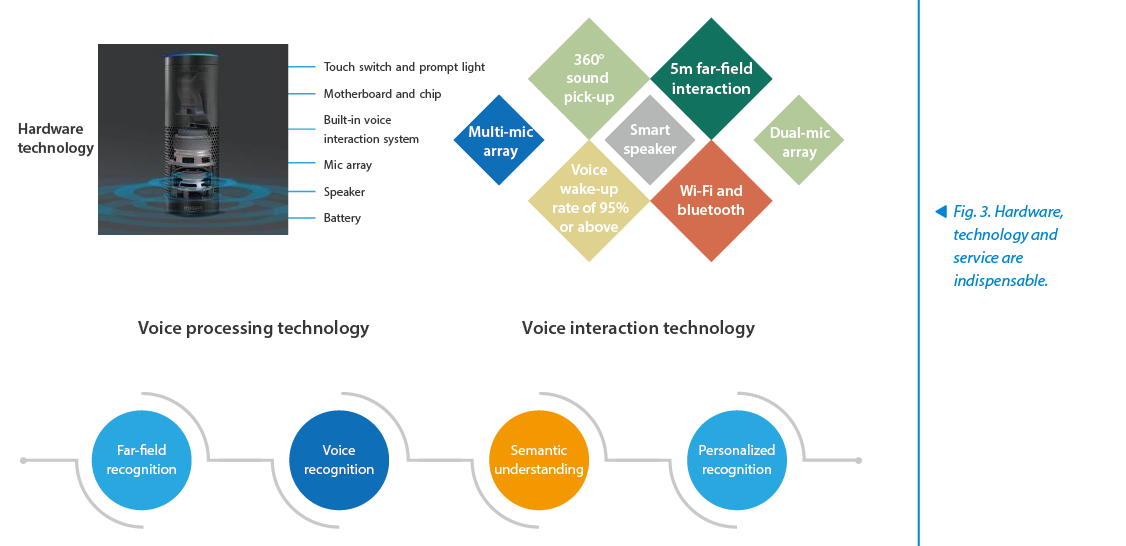

Experience is king. To deliver a superior AI-based user experience and become a must-have for households, smart speakers must be truly:

— Audible. Using far-field voice technologies including speech enhancement, sound source location, beamforming and echo suppression, smart speakers can provide wake-up and identification services that are more accurate, faster and more stable (Fig. 3).

— Understandable. Through deep learning, smart speakers can strengthen their natural language processing (NLP) capability and boost their understanding capacity close to that of humans. Only when the person who speaks is identified can a real conversation between man and machine be achieved.

— Smart. By integrating the industry chain and improving the ecosystem, industry players can make rich content and excellent services available to smart speakers so that they can deliver a really smart experience.

Opportunity: The Entry Point for Operators to Embrace the AI Era

In 2018, home broadband and video services experienced rapid development, while AI began to play an increasingly strategic role in video services. Operators are bundling 100M bandwidth, 4K UHD, and intelligent networking with the smart home. By building a new ecosystem and a new portal in this way, operators hope to explore new revenue sources in new areas.

Smart consumer products, especially smart home offerings, will be the main driver of a consumption upgrade in China in the near term. Undoubtedly, they have a strong attraction for operators. On the one hand, operators face uncertain revenue growth because their data dividend will soon disappear thanks to the rapid adoption of unlimited-data plans, but on the other hand, they have inherent advantages for building a smart speaker ecosystem because they possess pipe and platform resources. By seizing the voice portal of the household, operators can accelerate the deployment of smart home and new services to tap opportunities in the new segment.

At the "Digital Sichuan" meeting held in May 2018 to order pan-smart terminals, the Sichuan branch of China Telecom (Sichuan Telecom) purchased 5.78 million pan-smart terminals, including 2.48 million smart speakers and 2.41 million smart control devices. To gain entry into homes, Sichuan Telecom adopted the "1+1+N" sales model, which was complemented with strong channels and heavy subsidies to achieve quick results. The sales model plus the complementary measures made the smart terminals project of Sichuan Telecom a classic case of "pinpointing the entry point and quickly scaling up". The first 1 in the sales model refers to the smart speaker, which is the voice portal of the home. The second 1 stands for the smart control device, such as a smart plug or smart infrared gadget, which is used to control traditional household appliances. The N represents other smart home devices, including smart locks, smart curtains and smart routers.

The "1+1+N" model allows operators to first use a smart speaker plus a smart control device to gain entry into the user home and then keep adding other smart gadgets to complete the setup of whole-home intelligence. Among all the products involved, the smart speaker is the portal and therefore has strategic significance. As a long-term partner of telecom operators, ZTE always seeks to continually create value for customers through technological innovations. The series of smart speakers developed by ZTE, including the pure-play speaker, speaker plus STB, and speaker plus phone, can assist operators in strategic planning and intelligence-based home transformation.

Conclusion

Chinese telecom operators have hundreds of millions of home broadband users and an associated sales and service system. The smart speaker is the portal to the smart home and should be the focus of operators before they integrate core services including IPTV, smart home and IMS voice. The eventual win-win smart home ecosystem involving all industry partners should include the smart speaker as the unified portal, the smart home product portfolio as the core carrier, and smart operations as the way of traffic monetization.

[Keywords] Smart speaker, AI era, traffic portal, entry point, STB