The Prospects for CDMA and the Rise of ZTE

This IDC update provides a summary examination of developments and prospects for the CDMA market. It takes into particular consideration recent IDC conversations with CDMA service providers carried out between late June and July 2010. This effort also includes attending a CDMA Development Group (CDG) presentation as well as participating in a CDMA operator conference.

Situation Overview

CDMA technology has faced many challenges. Most recently, reduced spending in the key CDMA market of the United States has noticeably shrunk the overall infrastructure opportunity. Top CDMA operators Verizon Wireless and Sprint certainly maintain sizable budgets for expanding and maintaining their existing networks. However, a large portion of their capital expenditures have shifted to next-generation technologies such as LTE and WiMAX. Coupled with technology shifts by a number of CDMA operators in regions such as Asia/Pacific and Latin America, the overall global market for CDMA infrastructure has indeed been on a decline.

To further examine the prospects for CDMA infrastructure, IDC held a series of conversations with a variety of CDMA operators and proponents from around the world. The variety of and global viewpoint of these conversations were critical to ensuring that they provide a thorough picture of the prospects for CDMA. One of the more notable themes to arise was that, while the market as a whole has seen an overall decline in recent years, the pace and actual experience have varied. Pockets of opportunities persist for CDMA. Markets such as China, India, and a number of other countries (particularly in emerging markets) offer dynamic—and in some cases even modestly expanding—opportunities. Overall, some of the key themes that arose from the conversations with CDMA operators and proponents revealed the following:

■ CDMA is alive and well

CDMA remains a sizable market with a vibrant community of operators successfully delivering innovative mobile voice and data services in all parts of the world. According to the CDG, the roster of operators now numbers some 310 commercial entities, of which there are 114 EV-DO Rev.0 and 94 EV-DO Rev.A networks. There were in sum 522 million CDMA subscribers at the end of 2009 (specifically, 518 million CDMA2000 and 142 million CDMA2000 1xEV-DO subscribers). In fact, there are now two commercial EV-DO Rev.B networks (Indonesia and Pakistan). CDMA has not evolved to be the dominant wireless infrastructure technology out there—but it certainly continues to have its place in the portfolio of wireless technologies that are delivering important connectivity services to consumers across the globe.

■ EV-DO Rev.B sees a second lease on life, courtesy of China Telecom

In relatively modest efforts, Rev.B networks have been launched by PT Smart Telecom and Pakistan Telecommunications. This is notable because since the time Verizon Wireless chose to move to LTE, much of the momentum behind Rev.B had slowed and in many respects the technology had been written off. However, through the persistence of the CDG and key technology vendors and the support of several operators, Rev.B is seeing some renewed momentum. Particularly noteworthy is the support offered by China Telecom. China Telecom is trialing Rev.B in three cities and shows a clear openness to its potential commercial deployment. For the most part, the decision to move forward with Rev.B will be predicated on how subscribers’ data consumption behavior evolves on its network over the next 12–24 months. With aspirations to become the largest CDMA operator in the world by the end of 2010 (which in IDC’s view is likely to happen), China Telecom offers the kind of economies of scale that would bring an important critical mass to the Rev.B ecosystem.

■ The traditional (developed market) CDMA markets are waning, but opportunities remain in key emerging markets

To be sure, the U.S. market, which has long served as the foundation of the CDMA infrastructure opportunity, is still a significant market for CDMA infrastructure. Operators are still spending on their existing CDMA networks—expanding and maintaining them to meet ever-changing customer demands—and they will continue to do so for a long while. However, these networks are also maturing, and operators are transforming spending toward next-generation technologies. It is therefore of no surprise that the majority of CDMA-related expansion and subscriber growth resides in a region such as Asia/Pacific. As is the case in China, India, and other emerging countries, relatively low mobile penetration levels leave room for further growth.

Future Outlook

IDC anticipates CDMA will remain a sizable and important opportunity. It will certainly continue to play an important role in delivering mobile voice and data services to consumers and enterprises across the globe. In IDC’s view, the following three key themes will define the CDMA market ahead:

■ The CDMA market will continue to decline, but the opportunity will persist for the long term

There is no denying that, as a whole, the CDMA infrastructure market will continue to decline. This trend will persist as the world coalesces toward the 3GPP road map of LTE. The path toward this transformation will however be long and complex. Networks cannot be transformed overnight. It has taken until 2010 for overall 3GPP 3G spending to surpass 2G spending—a point of transformation that is as much as five years behind what many had predicted when 3G was first introduced at the beginning of this decade. The lesson there was that network transformation is time consuming and requires careful planning and anticipation of changing customer needs. Thus, for CDMA, it will not be disappearing overnight. Numerous operators IDC conversed with over the past several weeks expressed continued strong support for it. There is certainly the expectation that they will continue to spend on the technology as they maintain and expand existing networks—with the only caveat being that capital expenditure budgets will be bifurcated by an eventual shift toward next generation technologies such as LTE. The proportion LTE spending takes will naturally increase, especially during the second half of this decade as momentum for the technology builds in emerging markets.

■ Opportunities will be created in the CDMA to LTE transformation, while Rev.B provides a modest but notable upside

The potential with CDMA operators is defined by the sum of the CDMA infrastructure opportunity and the requirements arising out of the network transformations that will eventually be taking place. Ultimately, the customer target is the over 300 commercial operators involved in CDMA and selling them the necessary equipment and services to enhance existing operations—and then building upon that relationship to better position oneself for the next-generation build cycle. The CDMA opportunity naturally extends to LTE transformation. Rev.B will also present good opportunities, as evidenced by the nearly 15 operators planning to deploy it in the near term. Many more operators are likely to look into the technology, especially if a carrier such as China Telecom commits to it. While Rev.B will not create nearly the kind of opportunity the LTE transformation process will, it will be sizable nonetheless. Thus, for equipment vendors heavily invested in CDMA, it will be essential to hold on to customers via a strong CDMA value proposition to be effectively positioned as the key partner for the network transformations ahead.

■ Amid market transformations, vendor positions shift and ZTE rises

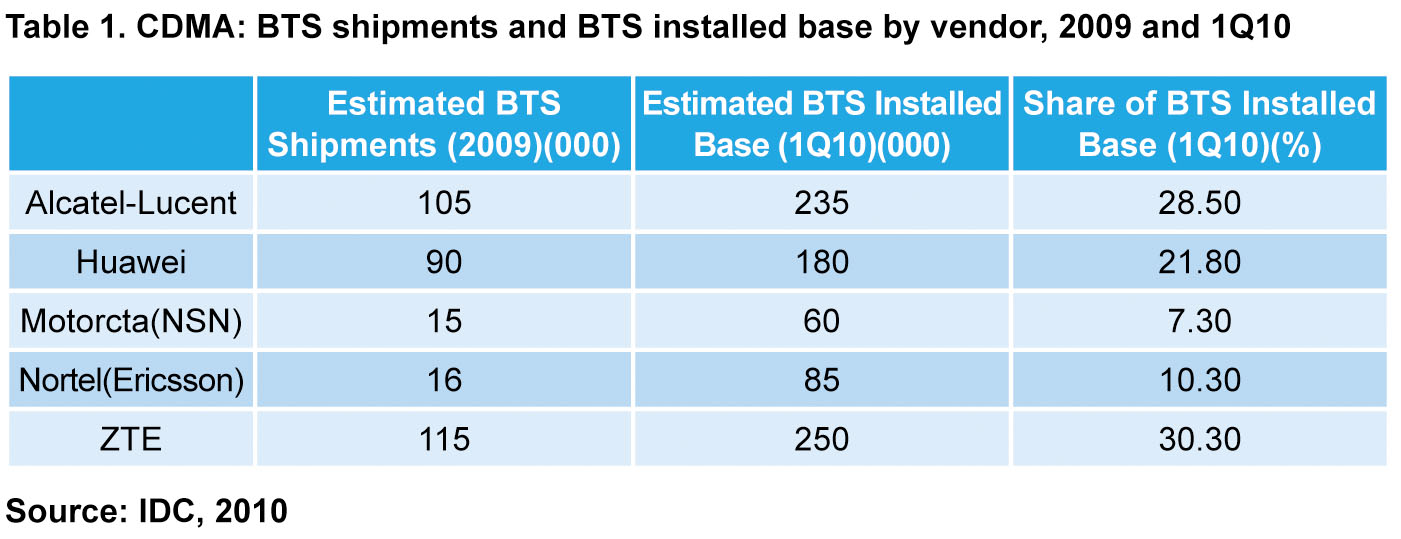

The CDMA vendor community is transforming as a result of the inherent stresses faced by the segment. Alcatel-Lucent, the longtime leader, maintains overall leadership in terms of revenue derived from the segment and is particularly strong in North America. Other traditional players such as Nortel and Motorola have faced many challenges and now have been acquired or are in the midst of being acquired by their larger 3GPP counterparts (Ericsson acquired Nortel’s CDMA assets, while Nokia Siemens is in the midst of acquiring Motorola's networks division). Amid the intensifying competitive pressures, it is Shenzhen based telecom equipment vendor ZTE that is thriving. Over the past five years, ZTE CDMA base station shipments have increased from a modest 9,100 in 2005 to (according to ZTE) a record level in excess of 115,000 in 2009. IDC’s review of 2009 activity confirms that this ranks ZTE as the market leader—in terms of both unit shipments and installed base of BTS (see Table 1).

The company has been pursuing CDMA opportunities throughout the world, and a particularly aggressive go-to-market approach in emerging markets has yielded ZTE strong dividends. ZTE has certainly benefited from the robust CDMA market in China. However, it is the attention placed in other parts of Asia and Africa that has allowed ZTE to further expand its volume of activity. ZTE has, for example, taken CDMA leadership positions in India and Indonesia, two of the more robust country markets today. As CDMA service providers have noted to IDC, ZTE is one of the most, if not the most, cost-competitive suppliers (this is especially true in emerging markets and also self-evident from the sheer volume of ZTE’s base station shipments). IDC’s observations of wireless infrastructure pricing patterns around the world reveal especially aggressive discounting of base station equipment in the past 18 months (in addition to increasingly creative financing strategies). Greenfield builds, especially those offering high volumes, see unprecedentedly low pricing. It is clear that there is a strategic imperative within ZTE to build market share in the near term. Customers also note the strong commitment to their local markets, a key attribute they look for when procuring equipment. ZTE’s strength in CDMA also does not stop at pricing and commitment. The company is increasingly known for its innovations and efforts to push the technology forward. ZTE was the first in the world to deploy a commercial EV-DO Rev.B network, providing equipment to Smart Telecom, which commercially launched Rev.B–based service in Bali, Indonesia, on January 10, 2010. ZTE also has a total of four trial and commercial EV-DO Rev.B engagements, making the company the most active and early leader. Further innovations and another first include trial deployment of dual-mode CDMA and LTE transformational base stations. While the Rev.B and transformational deployment is modest, it nonetheless allows for early experience in what will be an important competency for any CDMA supplier—deploying unified network elements capable of managing different generations of technologies.