Chinese PTN Market Development

Demand in the PTN Market

Once IP RAN is allowed for business use, it will have four main solutions—the adoption of layer 2 switches, router, combination of PTN and router, and complete end-to-end PTN. For carriers, the last two solutions offer the advantages of reliability, security, and low cost.

Fast development of 3G drives the PTN market

The rapid development of and increase in the need for 3G services demand higher quality of bandwidth. Owing to the low efficiency of traditional TDM-based transport networks, it is very difficult to fulfill the fast-increasing requirements for 3G bandwidth. Furthermore, in China, MANs comprise several networks, such as SDH/MSTP, Ethernet switches, and routers, each of which is responsible for providing different services and self-maintenance. The status cannot meet the demand for unified bearing and cost saving.

PTN is appropriate for carriers to ensure compatibility between 3G and 2G services. The advantage of service bearing enables PTN to support MANs for swifter, more efficient, and low-cost packet transport, and thus leads to the convergence of networks and unified bearing for services provided by carriers. The development of 3G will further stimulate the construction and expansion of PTN.

IP mobile network increases the demand for PTN

All IP has become the emerging trend for the development of communications services. IP mobile network requires higher standards for the services provided by bearing networks, including not only traditional services, but also clock, network delay, reliability, and security. The traditional transport technology of MSTP could not meet the requirements for IP RAN’s development, such as capability, expansion, cost, and others, which implies that a new type of packet-based bearing technology is needed to replace MSTP; PTN is appropriate for the same.

Existing network unlikely to meet the demands of group and family customers

The period 2011-2013 is likely to witness the rapid growth among two groups of customers—groups and families. Their demand for bandwidth, high reliability, high QoS, and less delay cannot be met by carriers’ existing networks.

Development of carriers stimulates the deployment of PTN

In telecom networks, services based on TDM are no longer demanded, and packet service is demanded by nearly 60-70% of the users. 3G has been allowed for business use. Although MSTP can deal with 3G in the initial stages, it cannot do so in the later stage. With the significant investment on bearing and transmission networks, MSTP is not likely to survive for a long time. Carriers need a network to support their service development for a long time. The development of mobile and wireless broadband increases the demand for mobile bearing transport largely. The deadline to meet carriers’ requirements for functions will not be fixed in the near future, as it will take some time to transform MSTP or routers for IP service, which does not bode well for carriers’ long-term development and investment. On the other hand, PTN is deployed to fulfill the long-term requirement of carriers.

Overview of Three Carriers’ PTN Deployment and Strategies

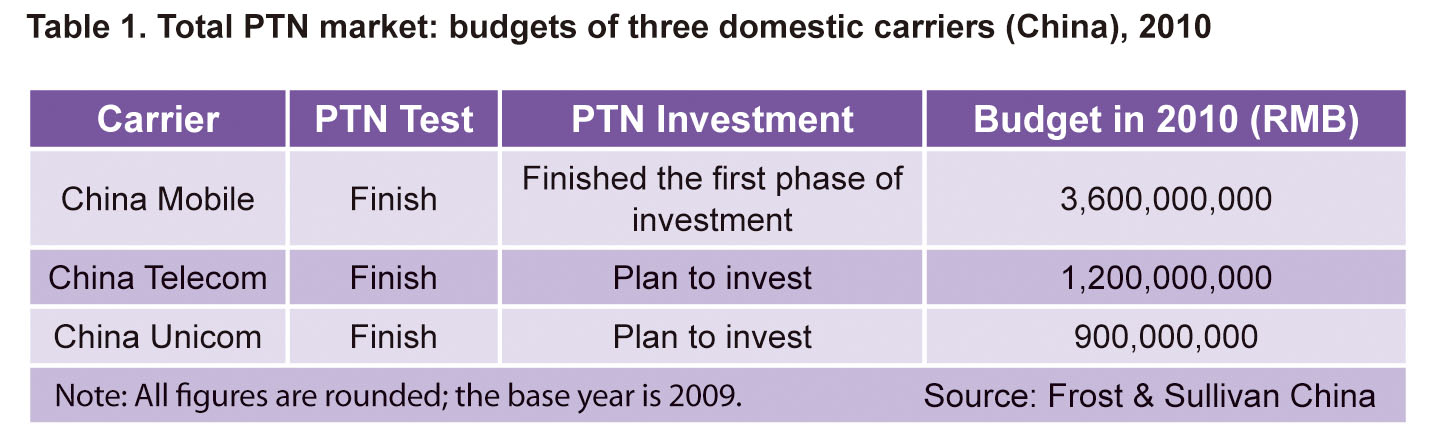

PTNs have progressed to the deployment stage, after the significant efforts to construction 3G base station and for the application of all IP services by three domestic carriers. Currently, they focus on IP transport network. China Mobile has taken the first step to make PTN tests, and it is followed by China Telecom and China Unicom. These three carriers are expected to invest more than RMB5.7 billion in the PTN market in 2010 (see Table 1).

China Mobile

China Mobile lacks fixed network resources, and its existing MSTP transport network has to handle 2G IP and TD-SCDMA IP services. Once 3G data services begin to be used rapidly, the deployment of PTN is likely to become inevitable.

China Mobile’s TD-SCDMA network is based on TDM. The deployment of PTN is essential to prevent any potential safety hazards created by Global Positioning System (GPS). China Mobile is the first carrier in China that focused on the PTN technology and completed the comprehensive tests for PTN equipment. Therefore, it has a complete knowledge of PTN. China Mobile has been focusing on PTN since April 2007, and it started laboratory tests in September 2007.

In 2010, the main challenges for China Mobile are likely to be the deployment and application of the PTN bearing network. For example, during the deployment, selection of the appropriate methods to prevent traffic jam by differentiating services in PTN bearing networks, report an emergency at the right time, administrate PTNs, plan the management of PTNs, and assess and control network environment is likely to pose a significant challenge. However, the application of PTN in large scale is expected to help carriers to find the appropriate solutions.

China Telecom

China Telecom’s PTN bearing services are access to the CN2MPLS VPN service, metropolitan Ethernet special line and L2 VPN service, data service bearing between 3G base station controller, and service bearing of softswitch, IPTV, IMS, and so on. After the adoption of the CDMA2000 network, China Telecom decided to improve quick-exchange rather than transform the network architecture. As a result, PTN is likely to be deployed later.

Currently, China Telecom has largely reduced the promotion of 3G data cards. It is mainly due to the reason that after the promotion of 3G data cards, the data service increased rapidly, and thus the optical metropolitan network, which originally connected base stations, could not meet the increasing requirement for transmission. As a result, China Telecom is keen to participate in testing the existing PTNs and is expected to start the deployment of new PTN in 2010.

China Unicom

Recently, China Unicom adopted strengthened MSTP for its backhaul instruction as well as focused on the PTN technology. Placement tests of PTN are likely to start in the near future. By the end of 2009, China Unicom had built 97,000 WCDMA base stations, 50% of which are now scattered in Southern China, which lacks fixed networks. PTN equipment, which are deployed only in 30% of base stations, will reach 15,000 sets in number, and the investment in 2010 in PTN equipment is estimated to reach RMB900 million.

Competitive Landscape of the PTN Market in China

With the development of 3G network and all relative services, carriers’ next responsibility is to build a high-speed data transmission network. This is likely to be a long process, as 2G networks need to undergo several years of construction and expansion. China’s PTN market has a significant potential. PTN is the initial stage in the process of transforming to 3G and full-service metropolitan network; this has to be considered by vendors when forecasting the development of this market.

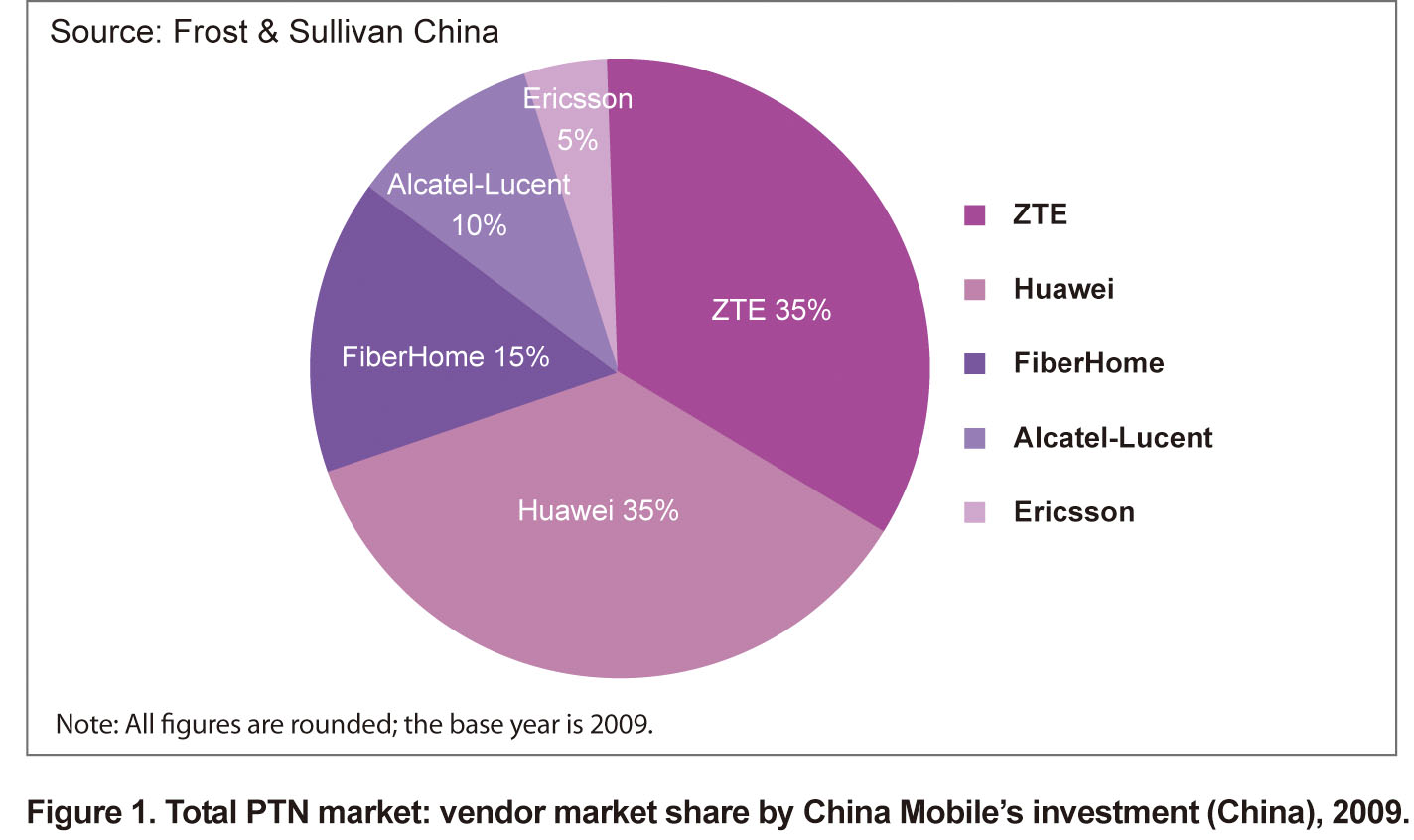

China Mobile’s first period of PTN collection CFB ended at the end of 2009. The bill, which amounted to around 3 billion, was shared by ZTE (35%), Huawei (35%), FiberHome (15%), Alcatel-Lucent (10%), and Ericsson (5%). Domestic vendors accounted for around 85% of the market share, which shows their dominance.

Figure 1 shows the increasing investment on PTN networks and competition among vendors. In the Chinese PTN market in 2009, ZTE and Huawei constituted the first tier of vendors in terms of the comprehensive assessment about their technologies, existing networks, and advantages of products. In the second tier, FiberHome, Alcatel-Lucent, and Ericsson have strong competitive abilities as well. Domestic telecom equipment vendors are changing their role from being followers to leaders.

PTN Market Forecasts

PTN market drivers

■ Demand for services—Key driver for the PTN market

Mobile services are shifting from using 3G to HSPA+ and LTE, which increases the demand for bandwidth. It requires PTN products to be able to deal with the growing packet service and reduce the transport cost of IP service. On the other hand, the long-time co-existence of several mobile standards demands PTN equipment to compact both TDM and ATM services. In addition to mobile services, PTN technologies have to deal with the demand for capacity of fixed networks. It can be achieved through multicast communication and VPN, which are able to provide better fixed services. Overall, the convergence of mobile and fixed networks is the key driver for the PTN market.

■ Suitable climate for PTN deployment

With domestic carriers starting to rearrange themselves, the Chinese PTN market is growing. In addition, the 3G market is developing in the country as well. These factors create a suitable climate for PTN to be deployed in a large and appropriate application environment in China.

■ Scale effect

China has many communications users and well-expanded networks. According to the plans mentioned in “the advice for building the third generation mobile communication networks”, 3G networks are likely to cover all the cities (cities over prefecture level and prefectures), most of the county towns and villages, main highways and scenery areas by 2011. The total investment in the construction of 3G networks will reach RMB400 billion, the number of base stations will exceed 400,000, and the users of 3G will be up to 150 million. The fast development and promotion of 3G will produce a significant scale effect, which is a good opportunity for the PTN market.

Key market trends

It is acknowledged in the market that PTN can help carriers to blend 3G and 2G for domestic carriers. PTN is the combination of SDH and IP, a technology to transform SDH with IP technology. However, the transformation involves some of SDH’s features, including network management and protection, as desired by carriers. Compared to SDH, which is the traditional transmission technology, PTN has apparent advantages in terms of bearing new services, and it is expected to replace SDH networks in the long term. Currently, with the support of mature technologies, SDH networks are stable and bear many TDM services that constitute the primary part of its operation. TDM is witnessing development. IP trend is a long process thus; SDH will not be replaced by PTN in a short period. The development of the PTN market is anticipated to facilitate the growth of other optical networks. In the near future, the PTN market is likely to possess a significant growth potential. The MSTP market has been increasing by RMB5 billion annually in the near past. The increasing demand for packet transport is most likely to encourage carriers to shift their investment from MSTP to PTN. Before 2010, the Chinese PTN market was in the infancy stage. Currently, China Mobile opens the PTN market, and China Telecom and China Unicom are preparing to participate in it. In 2010, the three largest carriers in China will develop their services, which will accelerate the commercialization of PTN that has huge potential to size more domestic market. From 2011 to 2015, the Chinese PTN market is expected to achieve rapid growth. The three domestic carriers are estimated to invest more than RMB5.7 billion in the PTN technology.